In a recent financial disclosure, Spirit AeroSystems, a leading aerospace manufacturer based in Wichita, Kansas, expressed “substantial doubt” about its ability to continue operations. This alarming revelation underscores the company’s escalating financial challenges, which have been exacerbated by production delays, labor disputes, and mounting debt.

Background and Significance

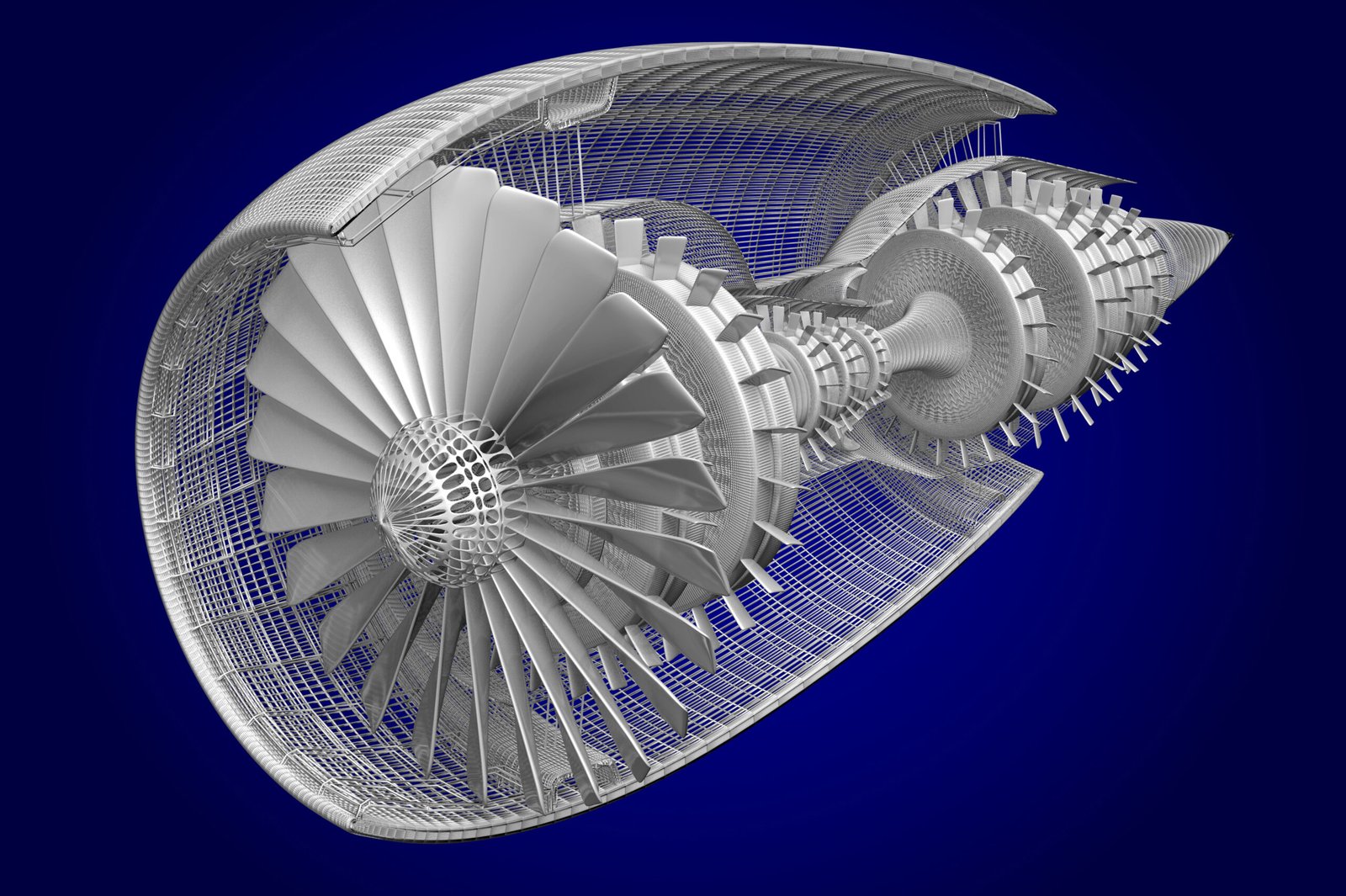

Spirit AeroSystems is a pivotal supplier in the aerospace industry, producing essential components for major aircraft manufacturers, including Boeing and Airbus. The company’s financial health is integral to the stability of the global aerospace supply chain. Therefore, its current predicament has far-reaching implications for the industry at large.

Financial Performance and Challenges

In the third quarter of 2024, Spirit AeroSystems reported a net loss of $476.6 million, a significant increase from the $101 million loss in the same period the previous year. Revenues for the quarter stood at $1.5 billion, falling short of analysts’ expectations of $1.68 billion. The company’s cash reserves dwindled to $218 million, down from $823.5 million at the end of 2023. These figures highlight the severe financial strain the company is under.

Contributing Factors

Several factors have contributed to Spirit AeroSystems’ financial woes:

- Labor Disputes: A prolonged strike by Boeing’s machinists, which began on September 13, 2024, halted production of key aircraft models, including the 737 MAX, 767, and 777. This disruption had a cascading effect on Spirit AeroSystems, leading to temporary furloughs of approximately 700 employees and exacerbating production delays.

- Supply Chain Disruptions: The company has faced challenges in meeting production schedules due to supply chain bottlenecks and increased labor costs. These issues have led to higher operational expenses and reduced profitability.

- Debt Burden: Spirit AeroSystems’ debt has risen to approximately $4.4 billion, further straining its financial resources and limiting its ability to invest in operational improvements.

Strategic Responses

In response to these challenges, Spirit AeroSystems has undertaken several strategic initiatives:

- Acquisition by Boeing: In July 2024, Boeing announced plans to acquire Spirit AeroSystems for $4.7 billion in an all-stock deal. This move aims to stabilize the supply chain and integrate operations more closely. The acquisition is expected to close by mid-2025.

- Cost-Saving Measures: The company has implemented cost-saving measures, including a hiring freeze, travel and overtime restrictions, and temporary furloughs, to conserve cash and manage expenses.

- Financial Restructuring: Spirit AeroSystems secured a $350 million bridge loan and a $425 million customer advance from Boeing to address immediate liquidity needs. However, these measures may not be sufficient to ensure long-term viability.

Industry Implications

The financial instability of Spirit AeroSystems has significant implications for the aerospace industry:

- Supply Chain Disruptions: As a key supplier, any operational disruptions at Spirit AeroSystems can affect production schedules for major aircraft manufacturers, potentially leading to delays in aircraft deliveries.

- Financial Contagion: The company’s financial difficulties could have a ripple effect on other suppliers and stakeholders within the aerospace sector, potentially leading to broader financial instability.

Future Outlook

The path forward for Spirit AeroSystems remains uncertain. While the planned acquisition by Boeing offers a potential lifeline, the company must navigate ongoing financial challenges and operational disruptions. Stakeholders will be closely monitoring developments to assess the long-term viability of Spirit AeroSystems and its impact on the aerospace industry.

Spirit AeroSystems’ recent disclosure of substantial doubt about its ability to continue operations highlights the critical challenges facing the company. The situation underscores the interconnectedness of the aerospace supply chain and the potential for widespread implications arising from the financial instability of a key supplier.